Gold prices closed lower for four weeks in a row, testing the lows of 2021.

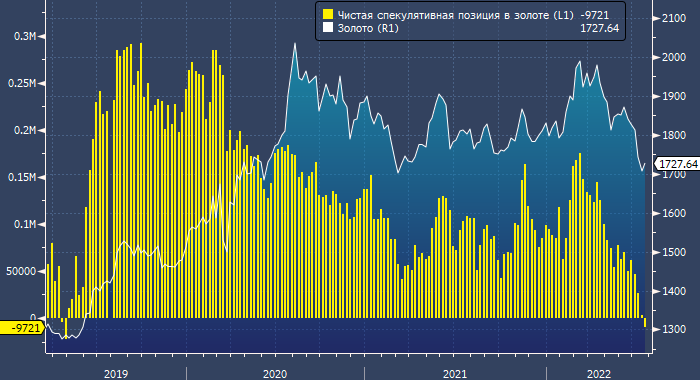

Net speculative position in gold (in number of futures and options contracts, yellow, left scale), and gold price (white, right scale) at 1 week intervals

In the week ending July 19, large speculators like hedge funds’ net gold position went from long (2,748 futures and options contracts) to short (9,721 futures and options contracts). These are the data published on Friday by the US Commodity Futures Trading Commission (CFTC).

This is the highest volume for a net short speculative position in more than three years. What’s more, it’s the first net short speculative position in the same three-plus years.

The volume of „dirty” long and short speculative positions in gold also dropped to a minimum and rose to a maximum over the past three years.

Note that gold prices closed down for four weeks in a row, testing the lows of 2021.

MarketSnapshot – ProFinance News. Ru and market events in Telegram